Whole Life Insurance - Cash Value

Whole life insurance is a permanent policy that lasts as long as you do. It includes a cash value savings element, which makes it more expensive than term life. If you’re a high earner or you have lifetime financial obligations, whole life insurance may be a good choice for you.

When you purchase whole life insurance, you get an easy way to financially protect your family without having to worry about the policy expiring. Like all life insurance policies, whole life pays a death benefit (tax-free) to your beneficiaries if you pass away while your policy is in force.

What You Should Know

- Premiums fund your policy and an extra cash value feature

- The cash value grows at a low rate, working like a guaranteed investment

- Policies are more expensive than term life insurance

- Whole life is best if you want coverage for your ENTIRE life or need an additional investment account

What Is Whole Life Insurance?

Whole life is a kind of permanent life insurance, also known as cash value life insurance. The policy is active as long as you pay premiums, which stay the same regardless of how long you have the policy. Whole life includes a savings component called the cash value that grows at an interest rate set by your insurance provider. You can access this cash value while you’re still alive, though it may come with a penalty.

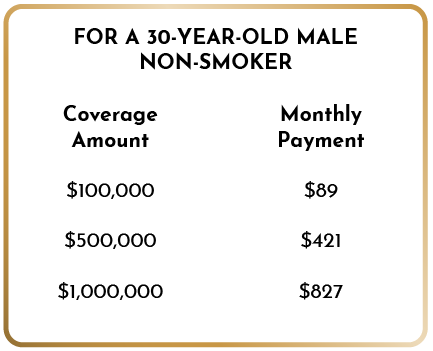

How Much Does Whole Life Insurance Cost?

The average cost of permanent coverage is $55-135 per month — much more expensive than a term life insurance policy with the same benefit amount. Whether you buy term life or whole life, your premiums will vary. They’re based on your health, age, coverage amount, term length, and riders you add (but some riders are FREE). The longer your life insurance policy lasts, the more it costs. The more coverage you get, the higher your life insurance premiums will be.

Medical concerns raise the cost of your premiums, and the older you get, the riskier you are to insure. Life insurance rates go up by 4.5-9% each year. Knowing this in advance will help you to not overestimate your ability to pay premiums year after year.

Sample whole life insurance premiums

Remember, rates will vary as unique circumstances will impact each person’s rate.

Tips for Buying Whole Life Insurance

No particular type of life insurance is best for everybody. However, here are some ways to decide which whole life policy is right for you and your family:

- Calculate how much coverage do you need: It depends on your income, but we typically recommend 10-15 times your salary. Factor in any debts you have and your family’s financial needs.

- Talk to your insurance agent: It’s important to compare companies and quotes, as each company has its own underwriting rules. Your advisor will shop around to help you find the best deal.

- Ask about riders: Costs for adding riders may vary, and not every insurer offers the same ones.

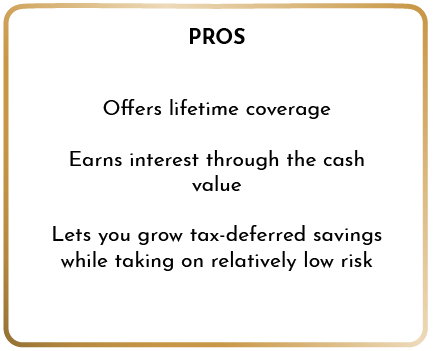

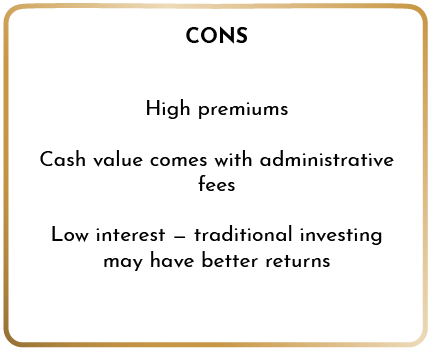

Pros and Cons of Whole Life Insurance

All life insurance policies have their own set of pros and cons. Here are the benefits and drawbacks of whole life:

What Are the Next Steps?

Once you’ve picked an insurance company and policy terms, buying coverage is pretty straightforward. You’ll complete your application, have a phone interview, and take a medical exam (for most traditional whole life policies, you cannot skip the exam).

The insurance company will review your application and medical records and issue you an “offer of coverage.” Once you sign the paperwork and pay your first premium, you’re covered for the rest of your life.

Is Whole Life Insurance Right for Me?

Whole life coverage is a low-risk investment that works well for people in certain circumstances, such as high earners seeking a new way to invest or those who care for a loved one who needs permanent financial support.

For more information about the policy details, or to discuss your life insurance options, contact The Think Wealth Group.